Alphabet Inc. (GOOGL) Stock Analysis: Navigating Market Volatility in 2025

As of April 17, 2025, Alphabet Inc. (NASDAQ: GOOGL), the parent company of Google, is at a pivotal moment. For retail investors watching the market closely, understanding Alphabet’s recent performance and long-term potential is crucial — especially as the stock faces turbulence driven by both global and industry-specific factors.

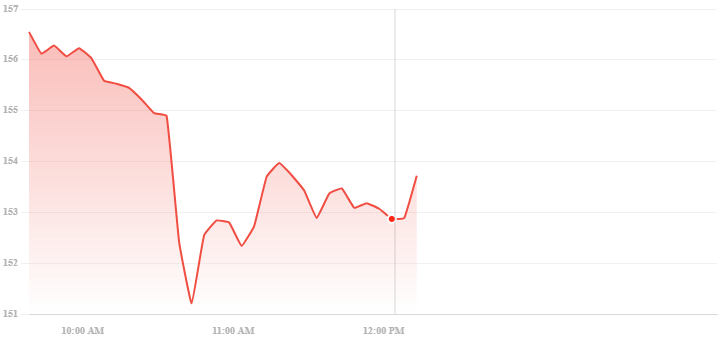

📉 Recent Stock Performance

Alphabet’s stock has declined by roughly 20% since January 2025, a notable dip that mirrors broader pressures across the tech sector. The pullback follows a mix of macroeconomic uncertainty, including renewed trade tensions between the U.S. and China and regulatory scrutiny in both Europe and the United States.

Despite these challenges, Alphabet’s fundamentals remain relatively strong.

💼 Q4 2024 Earnings Snapshot

- Revenue: $96.5 billion (slightly below expectations)

- Earnings Per Share (EPS): $2.15 (above estimates)

- Google Cloud Revenue: Up 30% year-over-year

The slight revenue miss concerned some investors, but the earnings beat and continued cloud growth helped soften the blow. Notably, Google Cloud is emerging as a key growth engine for Alphabet as it gains ground on competitors like Amazon AWS and Microsoft Azure.

🚀 Growth Drivers for 2025

- Artificial Intelligence (AI): Alphabet is doubling down on AI across its ecosystem—from Search and Ads to autonomous driving (Waymo) and productivity tools (Google Workspace). Its early lead in AI could give it a lasting edge.

- Cloud Services: Google Cloud is not only growing fast but also gaining more enterprise clients, contributing to Alphabet’s diversification away from ad revenue.

- Advertising Platforms: Despite some slowdown, platforms like YouTube and Google Search dominate the digital advertising space globally.

⚠️ Key Risks to Watch

- Regulatory Pressure: Alphabet is under increasing scrutiny, particularly in Europe under the Digital Markets Act, and in the U.S. with ongoing antitrust investigations. These could impact its operations and market dominance.

- Market Volatility: Broader tech market weakness and investor uncertainty may continue to drag on the stock, at least in the near term.

📊 Analyst Sentiment & Price Targets

Wall Street analysts remain cautiously optimistic. Price targets for Alphabet stock in 2025 range from $162 to $249, with many rating it a “Buy” or “Outperform” based on long-term growth potential.

🧠 Final Takeaway for Investors

While Alphabet is facing short-term headwinds, the company remains a tech powerhouse with strong fundamentals and exciting innovation in AI and cloud computing. For long-term retail investors with a high-risk tolerance, Alphabet could still be a compelling addition to a diversified portfolio — but it’s important to stay informed and keep an eye on the regulatory landscape.